ANZ Travel Visa Signature Card Review

So you've started working for a couple of years and your travel habits have been pretty much the same since ten years ago. You go to the airport at least two hours before your flight, you sit in a cafe (most likely Starbucks) with your iPad or a book and wait for the time to check-in your luggage. You make your way through immigration and walk around aimlessly in Duty Free Galleria (or equivalent) before sitting outside of the boarding gate with hundreds of other people, waiting to board the plane.

What if I told you a credit card from ANZ could change all that?

The Good

The ANZ Travel Visa Signature Card gives you an array of benefits. The one I value most, since I do not have an elite airline status, is the free (and unlimited) usage of airport lounges. Click here for a full list of Veloce lounges. Sure, some credit cards come with two or four guest passes into certain airport lounges but this card gets you in them without limit for free (as long as you're holding on to the credit card of course). If you would like to bring a friend, you should be able to just pay the guest fee. Otherwise, get your friend or family member a supplementary card and you're all set.

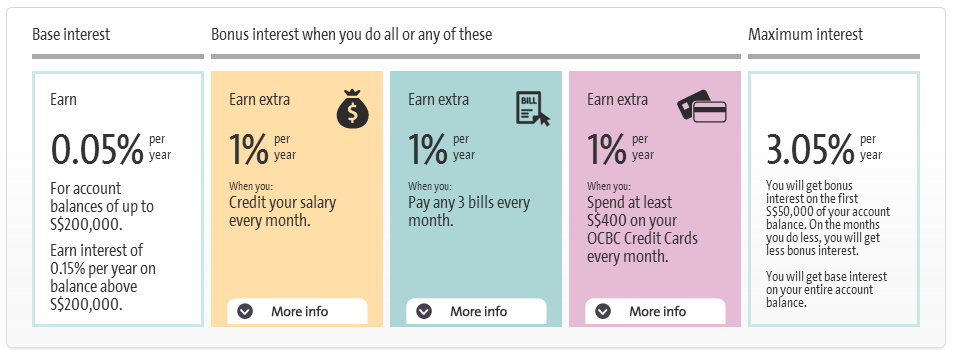

For those who enjoys cash rebates (certainly not me), this card gives you a flat 2.55% cash back for all expenditure made. You will receive 5.1% cash back if you purchase your flights directly with airlines, spend in Australia and New Zealand or if you shop at selected partners (e.g. HotelClub, AsiaTravel). For those who enjoy collecting miles, this card gives you 1.4 miles and 2.8 miles per dollar respectively. See the photo below for a full list of places where you can earn 2.8 miles per dollar. The best part of it is that you may choose to collect both miles and cash rebates and you can definitely do that by converting your Travel$ into respective redemption options. For more travel hacking tips on maximising your dollar, check out my previous post!

If you charge S$1,500 to your ANZ Travel Visa Signature Credit Card within 30 days, you will receive a free limousine ride to Changi Airport. There's also complimentary travel and accident insurance of up to S$1 Million for yourself (and up to S$100,000 for your spouse/children) if you charge your travel purchases to this card.

The annual fee for this card is S$200 (waived for the first year) but upon renewal, you will receive 12,000 Travel$ which is equivalent to 12,000 miles or S$215 cash rebate. Essentially, by paying the annual fee, you will earn S$15 on top of all the benefits the card gives you.

The Bad

Of course, as much as I love this card, there's one thing that truly annoys me. There's no way you can view your transactions online. You actually do have to wait for your monthly statement by post. That being said, that's probably the only thing I cannot stand about it. Well, perhaps the design of the card can be better improved too.

Successful applicants may also earn up to 4,750 Travel$ ($85 cash back or 4,750 miles) upon charging at least $700 to their card within 30 days from the date of approval. More information on the ANZ Travel Visa Signature Card here.

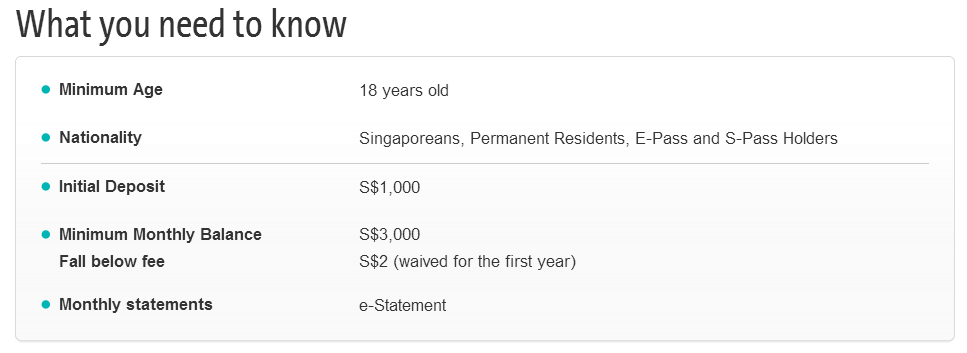

Eligibility

Applicants must be between 21 and 65 years of age

Singapore Citizens and Permanent Residents: Minimum income of S$60,000 p.a.

Foreigners: Minimum income of S$90,000 p.a.

Annual fee

Principal Card: S$200 p.a. (waived for the first year)

Supplementary Card: S$100 p.a. (waived for the first year).