UOB One Account Slashes Interest Rates from 1 May 2025 – Here’s What You Need to Know

With effect from 1 May 2025, UOB will be cutting bonus interest rates on the UOB One Account, reducing the maximum effective interest rate from 4.0% p.a. to just 3.3% p.a. on balances of up to S$150,000. While the revised rates are clearly a step down, they’re not entirely unexpected. With both SIBOR and SORA trending downwards for some time now, a move like this felt inevitable as interest rates across the board begin to soften.

Photo Credit: UOB

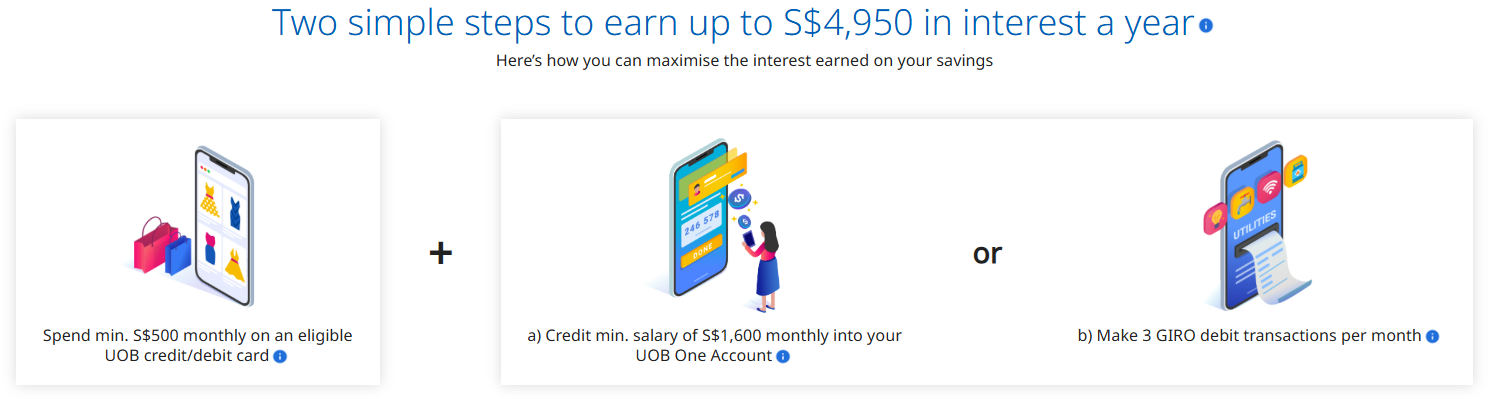

That said, earning up to 3.3% p.a. on balances of up to S$150,000 in a near risk-free environment remains a fairly attractive proposition - especially when you consider the current volatility and uncertainty in broader investment markets. For the purpose of this article, I’ll be focusing on the maximum effective interest rates - which assumes you credit a monthly salary of at least S$1,600 and spend a minimum of S$500 on an eligible UOB card.

| Account Balance in UOB One Account | Current Rate (Until 30 Apr 2025) |

Revised Rate (From 1 May 2025) |

|---|---|---|

| First S$75,000 | 3.00% p.a. | 2.30% p.a. |

| Next S$50,000 | 4.50% p.a. | 3.80% p.a. |

| Next S$25,000 | 6.00% p.a. | 5.30% p.a. |

| Above S$150,000 | 0.05% p.a. | 0.05% p.a. |

Although the bonus interest rate varies depending on the monthly average balance in your UOB One Account — with the highest rates applying only to balances between S$125,000 and S$150,000 — the effective annualised bonus interest will drop from 4.0% p.a. to 3.3% starting 1 May 2025. In practical terms, if you maintain exactly S$150,000 in your account, your annual bonus interest will decrease from S$6,000 (at 4.0%) to S$4,950 (at 3.3%)

While this revision is undeniably a downgrade, the UOB One Account still stands out as one of the best savings accounts to park your money in Singapore in 2025. There are plenty of alternatives out there, and while some may advertise higher interest rates, they often come with a long list of requirements and hoops to jump through. What makes UOB One so compelling is its simplicity — you only need to credit your salary, and spend at least S$500 on an eligible UOB card to unlock the maximum bonus interest rate. Personally, I use the UOB Lady’s Solitaire Card to earn 4 miles per dollar on my chosen spend categories (capped at S$2,000 per calendar month). If you're using the UOB Lady’s Savings Account alongside it and maintain a balance of S$100,000, you can even boost that earn rate to an impressive 10 miles per dollar.

UOB has launched a Tax Saver Promotion for the UOB One Account, running from 1 April 2025 to 31 March 2026. Under this promotion, customers who credit their IRAS tax refund directly into their UOB One Account will receive up to S$600 in rebates. It’s a small but easy perk for existing account holders — and a simple way to get a bit more back from your tax season:

Step 1: Register your mobile number for PayNow on UOB TMRW.

Step 2: Activate Money Lock on UOB TMRW (minimum $1 lock amount).

Step 3: Apply for GIRO Monthly Tax Payment Plan through IRAS portal, select UOB One Account for deduction.

Register now to earn 777 Bonus Points per night on eligible Hyatt stays at casino hotels between 14 July and 30 September 2025.